In seeking Shariah compliant investment opportunities, the open-ended SEDCO Capital IPO Fund is categorized as high risk because its main focus would be on new offerings at the Saudi Stock Exchange.

Following its launch on the 18th August 2024, the fund aims to achieve medium- to long-term capital growth by investing in public equities comprised of:

- IPOs of companies on both the Main Market and the Parallel Market,

- Rights issues of companies listed on the Saudi exchange,

- IPOs of real estate investment traded funds (REITs),

- Money market transactions, and

- Sukuk.

Over 50% of the fund will be invested in IPOs while holdings in rights issues are capped at 50%. A 40% maximum applies to other instruments the fund can invest in. While the fund is barred from lending activities, it can obtain Shariah financing up to 15% of the available net asset value.

Managed by Saudi Economic and Development Securities Company (SEDCO Capital), the active investment strategy is benchmarked against the SC Saudi IPO Total Return Index.

Aimed at qualified residents and institutions within Saudi Arabia, minimum initial subscription is SAR5,000 (US$1,331) and subsequent investments of at least SAR2,000 (US$532.30). Profits will be reinvested, not distributed, to optimize capital gains.

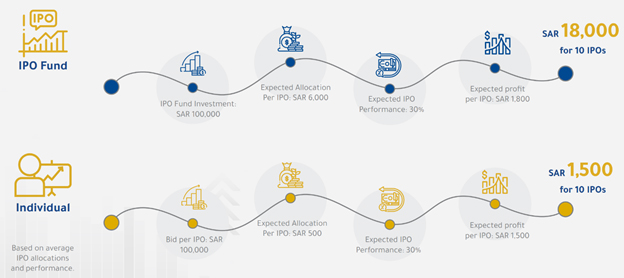

Chart 1: Illustrated comparison between IPO fund and individual investments

Source: SEDCO Capital

Touching on prospects, SEDCO Capital noted the Saudi Capital Market Authority had disclosed in February 2024 that 56 companies are in the pipeline for IPOs. Based on 73 IPOs listed on the Saudi exchange in the past 10 years, 85% had generated positive returns.

Adding that average total returns for IPO listings was 141%, SEDCO Capital pointed out that the mean return for these past IPOs was about 23% by the fifth trading day.

*Disclaimer: The opinions and viewpoints expressed in the Fund Profile do not constitute as a recommendation for any funds highlighted. The information presented is not investment advice and should not be treated as such.

| SEDCO Capital IPO Fund | |

| Fund manager | Saudi Economic and Development Securities Company (SEDCO Capital) |

| Launch date | 18th August 2024 |

| Asset class | Public equities |

| Base currency | SAR |

| Initial investment | SAR5,000 (US$1,331), subsequent multiples of SAR2,000 (US$532.30) |

| Investment objective | To achieve medium- to long-term capital growth by investing in public equities compatible with Shariah guidelines |

| Benchmark | SC Saudi IPO Total Return Index |

| Risk profile | High risk |

| Distribution | Profits reinvested, not distributed, to optimize capital gains |

Source: SEDCO Capital