ShariaPortfolio Global Wealth launched three target date funds on the 1st July 2024, which employ an asset allocation strategy designed for investors expecting to retire in the year of the fund’s name or have a long-term savings objective on or around that year (target date).

Made available via SP Funds Trust, each offering is essentially a Shariah compliant fund of funds, stocks and bonds — often touted as providing a “one-stop” or a “set it and forget it” retirement portfolio solution.

The funds will dynamically allocate monies across various investment classes, based on designated target retirement dates — ending respectively in 2030, 2040 and 2050. The asset classes include traditional long debt and equity investments, commodities (as diversifier and inflation hedge), direct holdings of real estate and REITs.

Seeking a high level of total return through its target date, each fund’s equity proportion declines over time following a predetermined glide path as the retirement date nears. In essence, each fund primarily seeks high current income and secondarily capital appreciation.

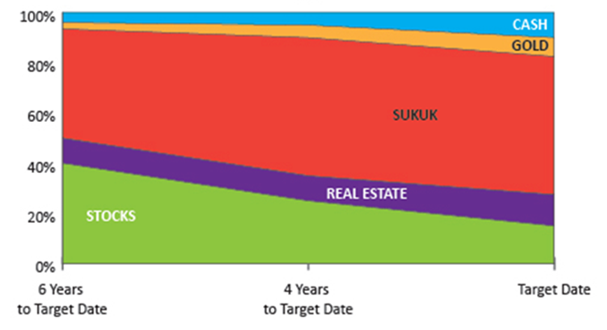

Chart 1: Investment glide path of SP Funds 2030 Target Date Fund

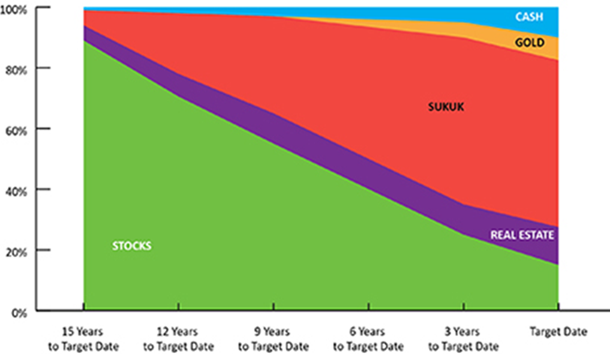

Chart 2: Investment glide path of SP Funds 2040

Target Date Fund

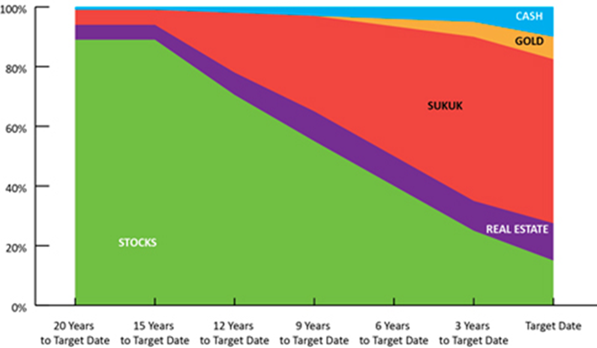

Chart 3: Investment glide path of SP Funds 2050

Target Date Fund

SP Funds Trust President Irfan Chaudhry said options for each fund to “invest include SP Funds S&P 500 Sharia Industry Exclusions ETF, SP Funds Dow Jones Global Sukuk ETF, SP Funds S&P Global REIT Sharia ETF, SP Funds S&P Global Technology ETF and SP Funds S&P World (ex-US) ETF”.

Describing these as the first set of Shariah compliant target date funds, Irfan added: “These types of funds are increasingly becoming a vehicle of choice for the investors, … reaching a record high of US$3.5 trillion in assets under management (AuM) at the end of 2023.”

Noting that investors preferred a lower risk approach to retirement and long-term savings, Irfan explained the firm’s Islamic investment approach will avoid risky allocations to highly leveraged instruments that other target funds might consider.

“The benefits of this approach were revealed in the financial crisis of 2008–09 and interest rate hike cycle of 2022–23, when Shariah compliant investors weathered the storm due to their lack of exposure to conventional financial services and highly leveraged companies.”

*Disclaimer: The opinions and viewpoints expressed in the Fund Profile do not constitute as a recommendation for any funds highlighted. The information presented is not investment advice and should not be treated as such.

| SP Funds 2030, 2040 & 2050 Target Date Funds | |

| Fund manager | ShariaPortfolio |

| Launch date | 1st July 2024 |

| Asset class | Mixed assets |

| Base currency | US dollar |

| Initial investment | US$50,000 for Institutional Class shares; US$250 for Investor Class shares with US$1,000 minimum account balance. Purchases restricted to residents within the US |

| Investment objective | To generate high current income and secondarily capital appreciation via a timeline glide path of target allocation among asset classes compatible with Shariah guidelines |

| Distribution | Net investment income monthly; net realized capital gains annually – automatically reinvested unless opted for cash payout |