Equity funds in the Middle East and North Africa (MENA) zone largely outperformed their respective benchmarks in 2023, according to the latest S&P Indices Versus Active Funds (SPIVA) scorecard.

With 71% of funds surpassing the S&P Pan Arab Composite LargeMidCap Index, the scorecard noted “2023 seemed not to be a challenging year for active equity managers”.

Overall, the scorecard said the 2023 performance came against the backdrop of high interest rates by central banks to combat inflation — which was driven by supply chain disruptions and war in Ukraine.

“Despite these economic challenges, the four MENA region indices exhibited positive performance ranging from 8.1% to 15.7% for the year.”

A drilldown of the statistics showed much of the gains came from stocks in the six GCC markets — comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE — which had foreign investment limits applicable.

While the S&P GCC Composite finished 2023 up 10%, “the S&P Saudi Arabia gained 15.7% in 2023, and 29% of funds underperformed the index. The category underperformance rate was among the smallest within all MENA categories over the one-year period”.

Expanding to the wider Pan Arab region — incorporating Egypt, Jordan, Morocco and Tunisia — the performance was slightly muted. In 2023, 54% of stocks in the S&P Pan Arab Composite underperformed the benchmark.

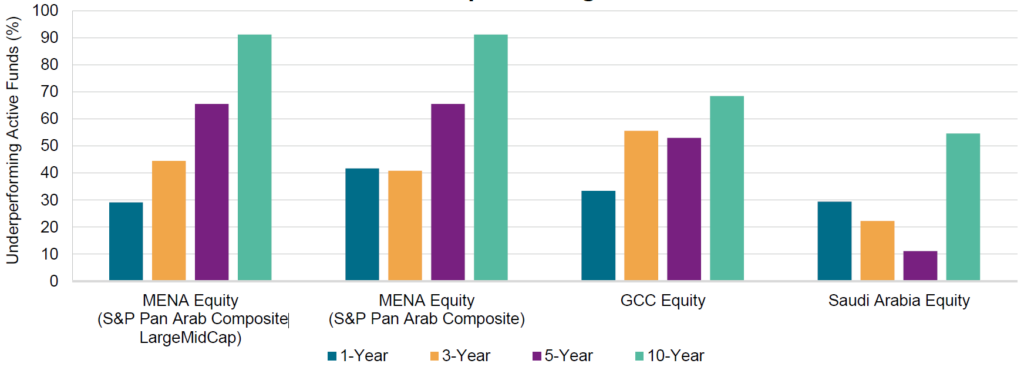

Chart 1: Percent of MENA funds underperforming their benchmarks

The SPIVA scorecard also noted that 91% of MENA equity funds underperformed both benchmarks over the 10-year period ending in 2023.

Even so, among countries in the S&P Pan Arab Composite, Egypt impressed. “As inflation soared and the Egyptian pound weakened, the stock market became an attractive hedge against eroding purchasing power.” Egyptian stocks in the benchmark collectively generated a 47% gain in 2023.

The scorecard said Bahrain and Morocco also emerged as star performers, boasting impressive returns, while Kuwait faced headwinds and delivered negative performance.

Sectorial analysis showed information technology and healthcare stood out, increasing 70.3% and 36.1% respectively. Although financials was by far the largest sector, with nearly one-half of the total index weight, it was among the lowest performers, increasing 7.7% in 2023. Further, there were 57 IPOs across MENA, with an average return of 12.5%.