Investing in both South African and foreign-listed equities, the Wealthvest Shariah Equity 27four Fund began operating on the 3rd March 2025 and was seeded with ZAR1.5million (US$82,612) by fund manager Wealthvest Investment Management.

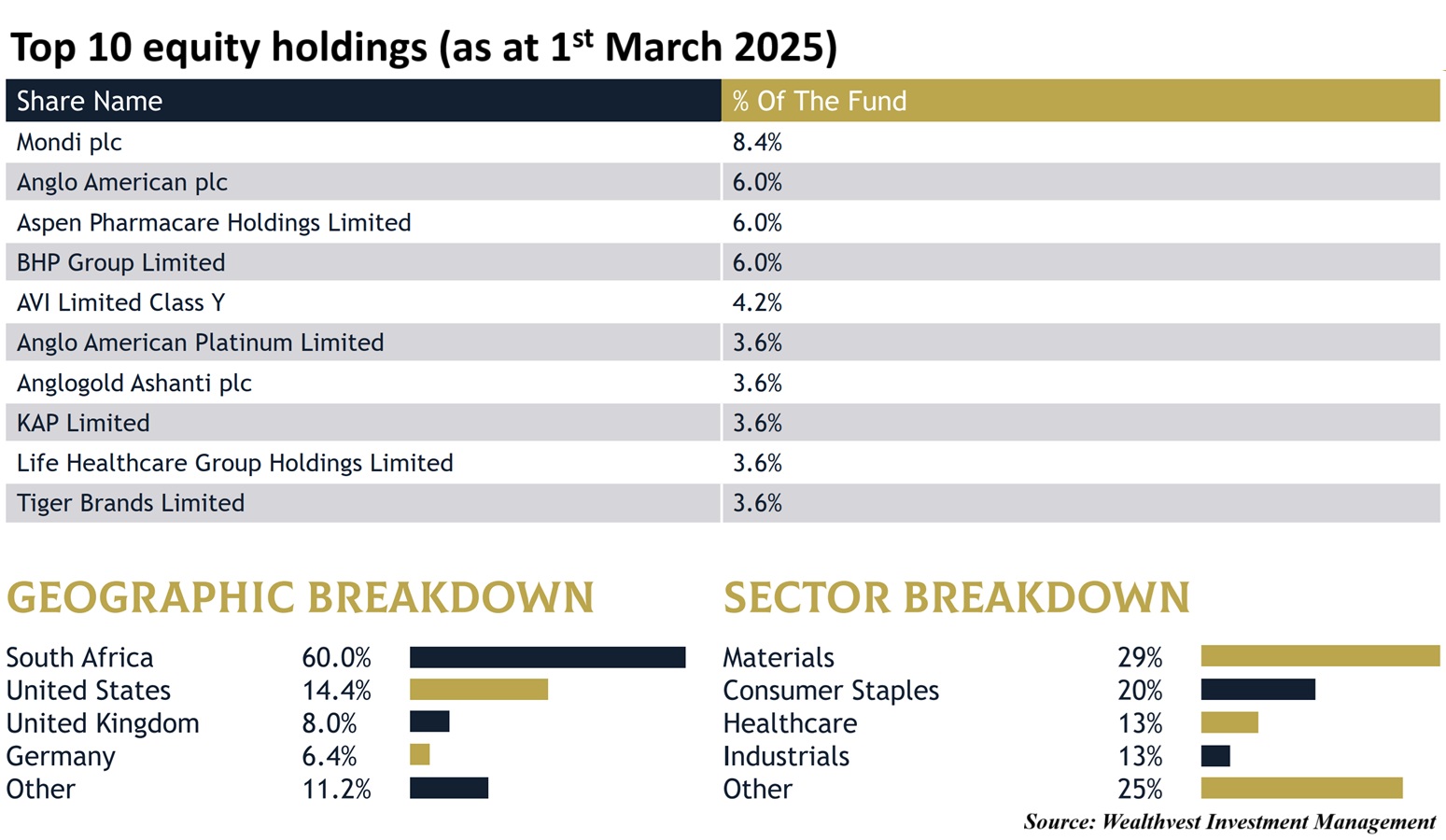

Portfolio manager Zaid Paruk told IFN Investor the ZAR-denominated fund strategy has a particular emphasis on consumer goods and resources, with 60% of its portfolio investments in South African equities.

As a South African domiciled fund, Zaid said it is required to hold at least 55% in locally-listed stocks and also a higher exposure toward resources.

While the fund also invests in US equity, it is underweight on big technology stocks, which differentiates it from other local funds that tend to be index-focused.

“US technology stocks tend to be very expensive, this was confirmed over past few weeks (in Q1 2025) as they have started to correct. Looking at the implied earnings required for investors on US technology stocks, the bar is very high. So it is unlikely that the current earnings growth will beat this,” explained Zaid.

“This Shariah compliant fund seeks a total portfolio return that outperforms the average return of general equity funds.” The fund target size has been set at ZAR500 million (US$27.54 million), with IdealRatings conducting independent purification services.

The fund manager is targeting less than 30 shares in the portfolio and seeking a low portfolio turnover of under 30% and a maximum of 5% weightage against the benchmark, depending on the opportunity and volatility in the market.

This is the first Shariah collective investment scheme launched for public subscription by Wealthvest, which obtained its fund management licence in January 2024 from South African regulator Financial Sector Conduct Authority. This Shariah fund is being operated with regulatory and administrative matters assistance of 27four Investment Managers, acting as the white label administrator.

While this fund is open to retail investors – who can invest from ZAR10,000 (US$550.66), together with monthly contributions starting from ZAR500 (US$27.53) – Zaid said Wealthvest is also eyeing institutional and accredited investors with minimum entries of ZAR500,000 (US$27,536) per investor.

With a risk profile of medium to high, Zaid said this fund is “suitable for those willing to tolerate short-term fluctuations in pursuit of long-term, Shariah compliant growth”.

Table 1: Key facts for Wealthvest Shariah Equity 27four Fund

*Disclaimer: The opinions and viewpoints expressed in the Fund Profile do not constitute as a recommendation for any funds highlighted. The information presented is not investment advice and should not be treated as such.

| The Wealthvest Shariah Equity 27four Fund | |

| Fund manager | Wealthvest Investment Management |

| Launch date | 3rd March 2025 |

| Asset class | Equities |

| Base currency | ZAR |

| Initial investment | ZAR10,000 (US$550.66) |

| Investment objective | Long term capital appreciation and income gains in accordance with Shariah principles |

| Risk profile | Medium to high |

| Distribution | Annually |