- US Islamic marketplace needs more content, a major lag to Canada’s growth

- Complex regulatory framework, lack of supportive federal laws among setbacks

- Notwithstanding challenges, growth and opportunity forecasts hold much promise

Overview

It’s a little-spoken yet tacitly understood phenomenon of the Shariah investment world: The US marketplace needs more Islamic content, but it is not happening as fast as the industry likes it.

Or rather, it isn’t happening at the pace set by Canada – the other North American market for Shariah, which has witnessed explosive growth in recent years.

According to market forecaster Pruduor, the global Islamic finance industry was valued at US$3.9 trillion in 2024 and is on a trajectory to reach US$5.95 trillion by 2026 and potentially US$12.5 trillion by 2033 – driven by a growing emphasis on ethical investing and corresponding demand for Shariah compliant products.

Within this burgeoning global landscape, North America, encompassing both the US and Canada, represents about 8% of the total Islamic finance market, with an anticipated revenue of US$1.24 trillion by 2024.

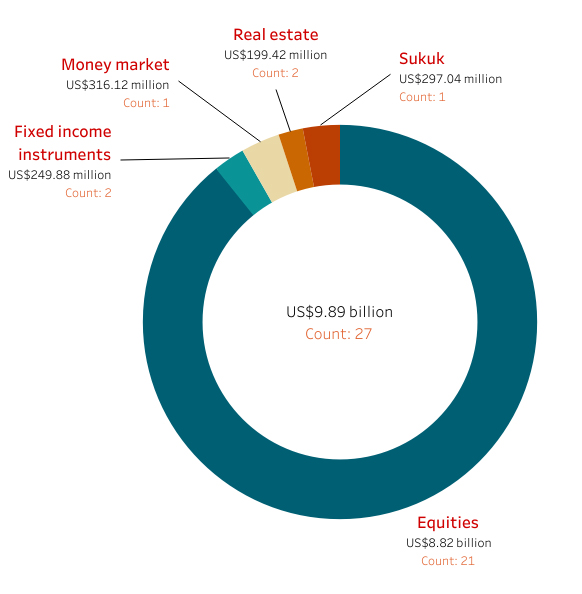

The IFN Investor Funds Database tracks 27 Islamic funds in the US, with a combined value of US$9.89 billion.

Pruduor data, meanwhile, suggests robust growth indicators for Shariah products in the US in 2024, with digital Islamic banking platforms expanding 38%, awareness of Shariah compliant investment tools up 33% and demand for ethical asset management among millennials and Gen Z surging 31%.

Sukuk issuances by institutional investors have risen 36%, the data shows, while ESG compliant Islamic funds have seen a 40% increase in participation. This growth is fueled by a US Muslim population projected to reach 8.1 million by 2050, a demographic with increasing financial capability.

But Canada, with its higher proportional Muslim population to the US (4.9% vs 0.9%), still stands out for its larger support base and demand for Shariah services. Firms like Manzil report waiting lists for over $10 billion in mortgage financing.

Crucially, the 2024 Canadian federal budget explicitly announced exploring measures to expand access to alternative financing, including Halal mortgages. This proactive governmental commitment is a stark contrast to the fragmented American case-by-case regulatory approach.

And while the US has a “much more sophisticated” regulatory framework, it often conflicts with Shariah principles, leading to limited formal entities offering Islamic finance products.

Investment opportunity

The US Islamic finance market presents compelling investment opportunities, driven by demographic shifts and evolving investor preferences. The expanding Muslim population, coupled with increasing mainstream interest in ethical and socially responsible investing creates a powerful synergistic effect.

Islamic finance principles inherently align with many ESG criteria, broadening the US market’s appeal beyond religious adherence to the rapidly growing global ESG investment pool, projected to hit US$30 trillion by 2025.

Demand for ethical asset management services among millennials and Gen Z in the US has jumped 31%, reflecting a strong inclination towards value-driven financial behavior. This demographic shift underscores a natural alignment with Islamic finance principles.

Despite all this and the sheer size of the country made up of its 50 states, the US Shariah market remains largely underserved – offering significant untapped potential for financial institutions that strategically embrace Islamic finance.

Historically, Islamic finance has demonstrated greater resilience during financial downturns due to its asset-backed nature and risk-sharing principles. This inherent stability can be a compelling draw for risk-averse investors seeking portfolio diversification and downside protection in volatile economic climates. Islamic funds have shown competitive performance, often matching or outperforming conventional benchmarks. The S&P 500 Shariah Index, for instance, posted an annualized total return of 10.2% over 15 years ended July 31, 2019, outperforming the conventional S&P 500’s 9.1%.

The nascent US market offers Islamic mutual funds, ETFs and home and commercial financing. Notable US-based Shariah compliant ETFs include the Wahed FTSE USA Shariah ETF and SP Funds S&P 500 Sharia Industry Exclusions ETF.

The global Sukuk market, reaching US$867 billion by Q1 2024 with an 18% compound annual growth rate (CAGR) since 2013, presents a significant, largely untapped opportunity for the US to develop its domestic Sukuk infrastructure. Currently, US Muslim investors often access Sukuk via international platforms, indicating a clear supply-demand gap.

Regulatory Framework

The US regulatory environment for Islamic finance is complex, characterized by a lack of specific federal legislation and reliance on case-by-case interpretations. Islamic financial institutions are governed by the same federal and state laws as conventional ones. While the OCC has approved Ijarah and Murabahah structures, deeming them “functionally equivalent” to conventional lending, significant challenges persist.

Conflicts arise from US consumer credit laws requiring interest rate disclosure, which Shariah prohibits. The US National Bank Act complicates Ijarah structures by restricting real estate holdings for debt security over five years. Commercial banks are generally restricted from equity stakes, hindering profit-and-loss-sharing arrangements like Musharakah and Mudarabah.

A major financial impediment is the double taxation of Murabahah contracts in 28 states, where they are taxed as sales rather than financing, increasing costs for consumers. The absence of a nationally chartered Islamic bank is another hurdle, due to difficulties in developing Shariah compliant, Federal Deposit Insurance Corporation products that are protected and comply with securities regulations. The “establishment clause” of the First Amendment also complicates the introduction of Takaful. Compounding these issues is limited awareness of Islamic finance among the general public and regulators, hindering systematic development.

Globally, the Islamic finance industry faces challenges from a lack of standardization and fragmented Shariah interpretations, leading to inconsistencies and a “global maze of red tape.” While organizations like AAOIFI and IFSB aim to unify standards, progress is slow. Liquidity management is also a significant challenge for Islamic banks due to the scarcity of Shariah compliant high-quality liquid assets, making it difficult to satisfy Basel III requirements. Solutions include issuing Sukuk bonds against long-term portfolios and developing common Musharakah pools.

Fund spread, performance

According to the IFN Investor Funds Database, equity funds account for the largest share of the US Shariah marketplace, with 21 of them making up US$8.82 billion – or 89% of the 27-fund total of US$9.89 billion.

The rest of the US Islamic fund industry is represented by the money market (one $316.12 million fund); Sukuk (one US$297.04 million fund); fixed income instruments (two funds worth a combined US$249.88 million) and real estate (two funds worth a combined US$199.42 million)

Chart 1: Components of US Shariah market

The biggest US Islamic funds are all equities-focused, with the US$2.39 billion Amana Growth Institutional Fund being the largest of them.

Next in line is the US$2.16 billion Amana Growth Investor Fund, followed by the US$1.09 billion SP Funds S&P 500 Sharia Industry Exclusions ETF, the US$1.02 billion Amana Income Institutional Fund and the US$772.77 million Amana Income Investor Fund.

Largest US Islamic funds

| Fund | Asset class | AuM (US$ million) |

| Amana Growth Institutional Fund | Equities | 2,390 |

| Amana Growth Investor Fund | Equities | 2,160 |

| SP Funds S&P 500 Sharia Industry Exclusions ETF | Equities | 1,087 |

| Amana Income Institutional Fund | Equities | 1,020 |

| Amana Income Investor Fund | Equities | 772.77 |

The mixed asset-based SP Funds 2040 Target Date Fund – Institutional is the top performing US Islamic fund with a three-month return of 7.08% during the January-March 2025 period.

Other leading performers for the three-month period include the Sukuk-focused SP Funds Dow Jones Global Sukuk ETF (2.07%), fixed income funds Amana Participation Institutional Fund (1.74%) and Amana Participation Investor Fund (1.69%) the money market Azzad Wise Capital Fund (1.47%).

Top performing US Islamic funds by three-month return

| Fund | Asset class | 3-month return (%) |

| SP Funds 2040 Target Date Fund – Institutional | Mixed assets | 7.08 |

| SP Funds Dow Jones Global Sukuk ETF | Sukuk | 2.07 |

| Amana Participation Institutional Fund | Fixed income instruments | 1.74 |

| Amana Participation Investor Fund | Fixed income instruments | 1.69 |

| Azzad Wise Capital Fund | Money market | 1.47 |

Fund performance of US Islamic funds by percentage (quarter-on-quarter)

| Fund | Launch | Asset class | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Average |

| Amana Developing World Institutional Fund | 30-Jun-2000 | Equities | 8.01 | 4.3 | 9.39 | -6.89 | -0.74 | 2.81 |

| Amana Developing World Investor Fund | 22-Dec-2000 | Equities | 8.04 | 4.15 | 9.28 | -6.91 | -8.53 | 1.21 |

| Amana Growth Institutional Fund | 1-Apr-2010 | Equities | 14.32 | 0.68 | 6.7 | -1.73 | 1.47 | 4.29 |

| Amana Growth Investor Fund | 25-Sep-2013 | Equities | 14.16 | 0.62 | 6.57 | -1.8 | -4.35 | 3.04 |

| Amana Income Institutional Fund | 28-Sep-2009 | Equities | 10.61 | 2.22 | 6.36 | -3.34 | -4.44 | 2.28 |

| Amana Income Investor Fund | 25-Sep-2013 | Equities | 10.53 | 2.17 | 6.22 | -3.41 | -8.25 | 1.45 |

| Amana Participation Institutional Fund | 3-Feb-1994 | Fixed income instruments | 1.92 | 0.68 | 4.37 | -0.91 | -8.29 | -0.45 |

| Amana Participation Investor Fund | 25-Sep-2013 | Fixed income instruments | 1.86 | 0.61 | 4.14 | -0.87 | -1.25 | 0.9 |

| Azzad Ethical Fund | 23-Jun-1986 | Equities | 14.91 | -1.37 | -2.33 | -3.92 | -1.31 | 1.2 |

| Azzad Wise Capital Fund | 28-Sep-2015 | Money market | 1.96 | 0.83 | 3.45 | -0.52 | 1.74 | 1.49 |

| Iman Fund | 28-Sep-2015 | Equities | 9.79 | 4.03 | – | -0.74 | 1.69 | 3.69 |

| SP Funds 2030 Target Date Fund – Institutional | 29-Aug-2024 | Mixed assets | – | – | – | 1.84 | -2.19 | -0.18 |

| SP Funds 2030 Target Date Fund – Investor | 28-Jun-2024 | Mixed assets | – | – | – | – | -2.25 | -2.25 |

| SP Funds 2040 Target Date Fund – Institutional | 29-Aug-2024 | Mixed assets | – | – | – | 4.66 | 7.08 | 5.87 |

| SP Funds 2040 Target Date Fund – Investor | 28-Jun-2024 | Mixed assets | – | – | – | – | -7.20 | -7.2 |

| SP Funds 2050 Target Date Fund – Institutional | 30-Jun-2024 | Equities | – | – | – | 4.19 | -8.14 | -1.98 |

| SP Funds 2050 Target Date Fund – Investor | 28-Jun-2024 | Equities | – | – | – | – | -8.19 | -8.19 |

| SP Funds Dow Jones Global Sukuk ETF | 27-Dec-2019 | Sukuk | -0.18 | 0.39 | 0.21 | -1.77 | 2.07 | 0.14 |

| SP Funds S&P 500 Sharia Industry Exclusions ETF | 17-Dec-2019 | Equities | 11.04 | 6.95 | 10.57 | 6.52 | -9.14 | 5.19 |

| SP Funds S&P Global REIT Sharia ETF | 29-Dec-2020 | Real estate | 1.86 | 13.28 | 8.66 | -9.31 | -0.43 | 2.81 |

| SP Funds S&P Global Technology ETF | 30-Nov-2023 | Equities | 15.9 | 14.11 | 10.9 | 3.51 | -10.1 | 6.86 |

| SP Funds S&P World ETF | 19-Dec-2023 | Equities | 4.66 | 7.1 | 10.99 | -6.24 | 0.42 | 3.39 |

| Wahed Dow Jones Islamic World ETF | 6-Jan-2022 | Equities | – | 3.19 | 7.3 | -7.4 | 1 | 1.02 |

| Wahed FTSE USA Shariah ETF | 15-Jul-2019 | Equities | – | 4.74 | 8.5 | 0.9 | -9.61 | 1.13 |

Outlook

The outlook for the US Shariah finance industry is characterized by robust growth projections and significant opportunities, tempered by persistent regulatory and standardization challenges. The global Islamic finance market is projected to grow at a CAGR of 12.67% from 2025 to 2033, reaching US$9.31 trillion, or $12.5 trillion with an 18.4% CAGR. S&P Global Ratings forecasts high-single-digit expansion for the sector in 2024-2025.

Key opportunities for the US market include the rapid adoption of fintech, with 35% growth in Islamic personal finance and 38% expansion in digital Islamic banking platforms. This digital transformation can overcome geographical barriers and enhance accessibility. The inherent alignment of Islamic finance with ESG principles presents a unique opportunity for broader market penetration, allowing the sector to strategically appeal to the rapidly growing global ESG investment pool.

Product innovation is crucial, with a need for a wider range of competitive Shariah compliant products, including stablecoin alternatives for crypto. Firms like Manzil are expanding into the US with faith-based investment solutions. Education and awareness remain paramount, as do proactive policy advocacy to reduce tax and regulatory impediments such as double taxation on Murabahah mortgages and fostering a more conducive environment for Sukuk issuance.

Persistent challenges include the industry grappling with an “identity crisis,” with many non-Muslims unaware of Islamic banking’s offerings. Talent gaps exist, with many financial institutions lacking expertise in structuring fully Shariah compliant fintech solutions. Addressing these challenges through talent development and awareness campaigns is crucial for long-term growth.