- Shariah fixed income offerings have grown from Asia to Gulf and Europe

- Sukuk issues could hit US$200 billion in 2025, from US$193 billion in 2024 –S&P

- Change in GCC Shariah standards, US Fed rate uncertainty key to any downside

Overview

Shariah compliant fixed income, with Sukuk as a major component, is emerging as a market of choice for those seeking returns along Muslim investing principles.

From Malaysia to Indonesia and Saudi Arabia to Luxembourg, the Islamic fixed income market provides access to specific and often rapidly-growing markets.

Continuous innovation in structuring to meet Shariah requirements has led to a variety of instruments with different risk-return profiles, catering to needs in Muslim-majority countries in Asia, the Middle East and North Africa as well as niche investors in Europe.

In Saudi Arabia and other GCC countries, as well as Malaysia and Indonesia, sovereign entities utilize Islamic debt instruments for government financing and market development. Supranational bodies like the IsDB are also significant issuers of such instruments.

Sukuk saw a 15% growth in issuance to US$193 billion in 2024, according to S&P Global Ratings, which projects this figure to reach as high as US$200 billion in 2025. A significant portion of the growth is expected to be in foreign currency-denominated Sukuk, estimated at US$70 billion to US$80 billion, which highlights international appeal and diversification within the market.

The higher Sukuk issuance forecast for 2025 draws on the assumption of a stable global liquidity environment, with no major shift to current Shariah standards and no significant escalation to geopolitical risks within the GCC — a crucial hub for Sukuk.

But the US Federal Reserve (Fed)’s disinclination to drop interest rates quickly could impact the issuance of bonds in 2025, including for Sukuk. US Fed Chair Jerome Powell told an event in Chicago on the 16th April 2025 that the central bank wished to see more US economic data before deciding on rates — despite pressure from President Donald Trump that there be quick cuts.

If the US Fed holds rates longer than thought, relatively higher cost of borrowing could result in issuance of bonds with higher yields to attract investors. The increased cost of debt servicing could also make issuers cautious about the volume of new bonds they bring to the market. Investors might also prioritize other forms of financing or delay projects where significant debt is required.

Investment opportunity

The Islamic fixed income universe is a diverse one, with multi-themed Sukuk offerings and other products that prohibit Riba and Gharar including Murabahah deposit, Islamic commercial papers, Islamic treasury bills and mutual funds that invest in a portfolio of Shariah compliant fixed income instruments.

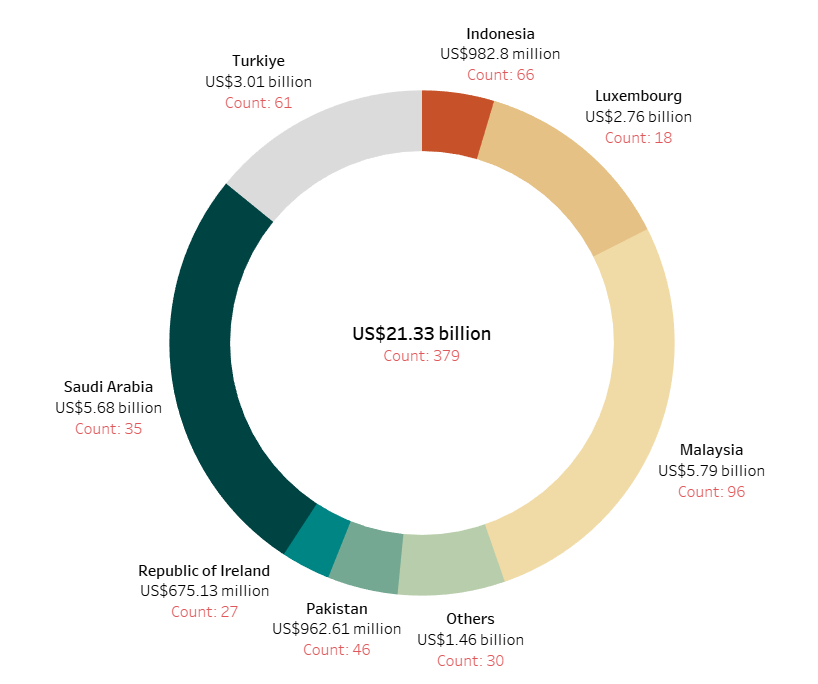

The IFN Investor Funds Database tracked 379 Islamic fixed income funds with assets under management (AuM) of US$21.33 billion across the globe for Q1 2025. Malaysia led the valuation, with 96 funds worth US$5.79 billion. Saudi Arabia was next, with 35 funds valued at $5.68 billion while Luxembourg was third with 18 funds worth US$2.76 billion.

In terms of value growth in Shariah fixed income funds, Europe saw a spike of 15.89% to US$6.46 billion, followed by the Americas’ rise of 7.63% to US$640.39 million and the Middle East’s 3.56% growth to US$6.17 billion.

Chart 1: Islamic fixed income fund by location, fund count and AuM

Table 1: Regional Islamic fixed income fund by value growth

| Region | Value |

| Europe | Up by 15.89% from US$5.43 billion to US$6.46 billion |

| Americas | Up by 7.63% from US$640.39 million to US$693.3 million |

| Middle East | Up by 3.56% from US$5.95 billion to US$6.17 billion |

| Africa | Up by 3.03% from US$147.41 million to US$152.01 million |

| Asia Pacific | Down by 2.84% from US$8.08 billion to US$7.86 billion |

Fund performance

Karachi-based HBL Asset Management’s Islamic Fixed Term Fund was the outperformer in Islamic fixed income markets for Q1 2025, delivering a three-month return of 17.53%, according to the IFN Investor Funds Database.

HBL says the fund’s objective was to “make investments in such a manner that the original amount of investment is protected whilst having the potential to yield positive return” at maturity. It invests primarily in Shariah compliant government securities, cash in bank accounts, money market placements, certificate of deposits and term deposit receipts with scheduled Islamic banks.

Albaraka Portfoy was second best, with a three-month return of 12.25% for its Albaraka Portfolio Management Second Rental Certificates Participation Venture Capital Investment Fund. Albaraka said its investments comprise equity and debt-type instruments at fair value through statement of income, equity-type instruments at fair value through equity, debt-type instruments at amortized cost, investment in real estate and investment in associates.

Mulkia Investment’s Mulkia Murabaha and Saving Fund was a distant third, with a three-month return of 5.4%. The fund says it aims to preserve capital, provide a high money liquidity ratio and earn short-term capital growth as a savings method for multiple categories of investors. It invests in money markets, debt instruments, derivatives contracts, bank deposits, money market funds and debt instrument fund units with fixed income that are Sharia compliant.

| Region | Fund name | Fund manager | Three-month returns |

| Africa | 27four Shariah Income Fund | 27 Four Investment Managers | 2% |

| Asia Pacific | HBL Islamic Fixed Term Fund Plan-I | HBL Asset Management | 17.53% |

| Middle East | Mulkia Murabaha And Saving Fund | Mulkia Investment | 5.4% |

| Europe | Albaraka Portfolio Management Second Rental Certificates Participation Venture Capital Investment Fund | Albaraka Portfoy | 12.25% |

| Americas | SP Funds Dow Jones Global Sukuk ETF | Sharia Portfolio | 2.07% |

Outlook

Overall, the Islamic fixed income market, with Sukuk as its primary instrument, is poised for sustained activity, offering Shariah-sensitive investors a growing array of opportunities for ethical and potentially stable returns while contributing to the expansion of Muslim financial universe.

It is important to note, however, that evolving Shariah requirements could introduce structural complexities in some GCC-issued Sukuk, potentially carrying additional risks for investors compared to conventional instruments. Geopolitical flare-ups in the Arab world could also be a risk to Sukuk issuance.

The other source of concern would be the US Fed and how quickly or otherwise it cuts rates in 2025, with longer wait out by the central bank potentially adding to US debt servicing costs that could reduce the volume of overall bond issuance impacting Sukuk.