- Robust Shariah financial landscape in a GCC founding member state

- Kuwait’s oil wealth generates liquidity that needs to be managed in Islamic way

- Increasing demand, evolving products benefit passive investors and risk-takers

Overview

Kuwait presents a robust and evolving market for Shariah compliant investing, which is deeply rooted in the cultural and religious landscape of a city-state that happens to be a founding member of the GCC.

Demand for ethical and faith-based investment options is strong in the oil-rich state of just around five million mostly Muslim people, driven by institutional and retail investors seeking alignment with their values.

While Islamic banks form a significant cornerstone of the financial ecosystem of the state that sits northeast of the Arabian Peninsula, Kuwait’s Shariah compliant investment space extends beyond traditional banking products.

The nation has historically benefited from strong liquidity generated by its oil wealth, which needs to be managed and deployed in Shariah compliant ways. Evolving demand for Islamic financial products enables both corporate and retail clients to feed and profit from this liquidity.

From money market to Sukuk, equity, real estate and fixed income offerings, passive investors — as well as active risk takers — have a chance for diversified returns in Kuwait.

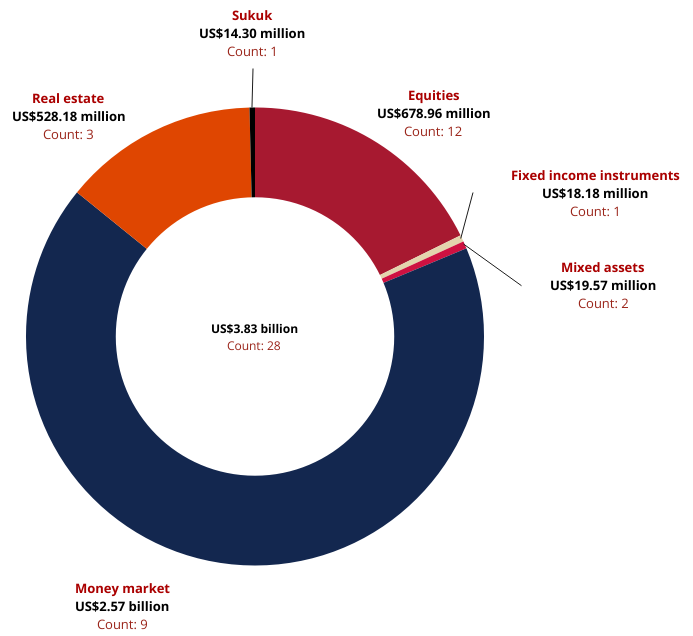

This is illustrated by the State’s Shariah compliant asset base of US$3.83 billion, managed by 28 funds tracked by the IFN Investor Funds Database as of Q1 2025. It also puts Kuwait at number two for Middle East-domiciled Islamic funds, behind Saudi Arabia’s asset base of US$47.07 billion but ahead of the UAE’s US$1.73 billion.

Investment opportunity

While oil is the number one economic driver of Kuwait’s economy, the very nature of the highly-geared — and, often, speculation-filled — trading markets in petroleum mean that Shariah investors would have to look at customized Islamic offerings to avoid the complications of Riba and Gharar.

Money markets lead Islamic funds activity in Kuwait, with the IFN Investor Funds Database listing a value of US$2.57 billion for this segment alone at the end of Q1 2025.

Next in line are equities, valued at US$678.96 million, followed by real estate (US$528.18 million), mixed assets (US$19.57 million) and fixed income instruments (US$18.18 million).

The largest fund manager in the country is NBK Wealth, whose flagship Watani KD Money Market Fund II had assets under management (AuM) of US$1.37 billion and a Q1 2025 return of 0.75%.

Kuwait’s second-largest fund manager is Boubyan Capital, whose income-based Boubyan KD Money Market Fund II showed AuM at US$872.28 million and Q1 return at 3.73%.

Boubyan said the fund’s strategy is to primarily invest in short- and medium-term Islamic instruments, along with Wakalah and Murabahah deposits with banks, and high-quality government and corporate Sukuk.

Markaz, also known as Kuwait Financial Centre, was the third-largest fund manager, with its Markaz Real Estate Fund returning 6.73% on AuM of US$239.75 million as of the end of March 2025.

But Markaz was also manager of Kuwait’s top performing fund by a one-year return. Here, its income-based equity-modeled Markaz Islamic Fund, with AuM of US$54.4 million, returned 9.2% at the end of Q1 2025.

On a shorter horizon, Kamco Invest came out tops for a three-month return, with its Kamco Islamic Fund declaring a gain of 8.3% on AuM of US$159.49 million as of the 31st March 2025.

Chart 1: Middle East-domiciled Islamic assets by AuM as of Q1 2025

Chart 2: Kuwait Islamic assets by asset class and AuM as of Q1 2025

Table 1: Top five largest Kuwaiti funds

| Manager | Fund | Type | Asset class | AuM (in US$ million) | Q1 return (%) |

| NBK Wealth | Watani KD Money Market Fund II | Income | Money market | 1,374.5 | 0.75 |

| Boubyan Capital | Boubyan KD Money Market Fund II | Income | Money market | 872.28 | 3.73 |

| Markaz (Kuwait Financial Centre) | Markaz Real Estate Fund | Income | Real estate | 239.75 | 6.73 |

| Warba Bank | Warba Islamic KD Money Market Fund | Income | Money market | 206.66 | 0.92 |

| KFH Capital | KFH Capital REIT Fund | REIT | Real estate | 197.56 | 1.16 |

Source: IFN Investor Funds Database

Table 2: Top performing Kuwaiti funds by one-year return

| Manager | Fund | Type | Asset class | AuM (in US$) | Return |

| Markaz (Kuwait Financial Centre) | Markaz Islamic Fund | Growth | Equities | 54.40 | 9.2 |

| Kamco Invest | Kamco Islamic Fund | Growth | Equities | 159.50 | 8.8 |

| KFH Capital | KFH Capital REIT Fund | REITs | Real estate | 197.57 | 8.08 |

| NBK Wealth | Watani Gulf Equity Fund | Growth | Equities | 162.34 | 7.99 |

| Markaz (Kuwait Financial Centre) | Markaz Real Estate Fund | Income | Real estate | 239.77 | 7.59 |

Source: IFN Investor Funds Database

Table 3: Top performing Kuwaiti funds by three-month return as of 31st March 2025

| Manager | Fund | Type | Asset class | AuM (in US$ million) | Return (%) |

| Kamco Invest | Kamco Islamic Fund | Growth | Equities | 159.5 | 8.3 |

| Boubyan Capital | Boubyan USD Liquidity Fund | Income | Money market | 71.19 | 4.26 |

| Al Safat Investment Company | Cap Corp Local Fund | Income | Mixed assets | 3.86 | 4.24 |

| NBK Wealth | Watani Gulf Equity Fund | Growth | Equities | 162.34 | 4.04 |

| Boubyan Capital | Boubyan KD Money Market Fund II | Income | Money market | 872.33 | 3.73 |

Source: IFN Investor Funds Database

Outlook

Kuwait Vision 2035, which primarily aims to diversify the economy away from its heavy reliance on oil, presents a compelling landscape of investment opportunities across diverse sectors such as infrastructure, renewable energy, healthcare and technology. The ethical and socially responsible nature of Islamic finance provides many ways of channeling investments into these opportunities.

On a more granular level, development of a deeper and more liquid Sukuk market and growth of equity and real estate funds, as well as trade finance, all structured in Islamic-friendly ways contribute to a vibrant and dynamic investment ecosystem for Muslims.

In conclusion, Kuwait’s Shariah market is expected to not only cater to the ethical preferences of investors, but also likely to be increasingly recognized for its potential to contribute to the State’s growth and diversification in the years to come.